California Health Insureance Need to Sign Up Again Each Year?

How much could you save on 2022 coverage?

Compare wellness insurance plans in California and bank check your subsidy savings.

Image: rawpixel.com / stock.adobe.com

California health insurance marketplace 2022 guide

Twelve insurers offer 2022 wellness plans through Covered California

- Louise Norris

- Wellness insurance & health reform potency

- February 25, 2022

California marketplace overview

California has a state-run substitution – Covered California. Twelve insurance carriers offering 2022 health insurance plans through the marketplace.

Over 1.8 one thousand thousand people enrolled in private individual-market plans through the California exchange during open enrollment for 2022 coverage.

Frequently asked questions about California's ACA market

Covered California announced in July 2021 that an boosted insurer, Vivid HealthCare, will be joining the marketplace, bringing the total number of participating insurers to 12 for 2022.

The following insurers volition offering plans in the California exchange every bit of 2022, with programme availability varying from one location to another:

- Anthem Bluish Cross of California

- Blue Shield of California

- Bright HealthCare

- Chinese Community Health Plan

- Wellness Net

- Kaiser Permanente

- L.A. Intendance Wellness Plan

- Molina Healthcare

- Oscar Health Plan of California

- Sharp Health Plan

- Valley Health Program

- Western Health Advantage

3 existing insurers program to expand their coverage areas equally well: Anthem Blue Cross of California, Blueish Shield of California, and Valley Health Programme. As a result, all residents will be able to select from at least 2 insurers, and nigh Californians will be able to select from amongst four insurers.

Anthem Blue Cross had offered plans statewide in Covered California prior to 2018, merely had sharply reduced their coverage surface area to just 3 of the state's sixteen rating areas as of 2018 (28 counties in Northern California, Santa Clara Canton, and the Cardinal Valley). For 2020, still, Canticle expanded their coverage area, returning to the Central Coast, part of the Central Valley, Los Angeles County, and the Inland Empire.

Market share in Covered California has evolved considerably over the years. Just three insurers had eighty percentage of the market share equally of the finish of 2016: Blue Shield had 31 percent, Anthem had 25 percent, and Kaiser Permanente had 24 percent. Those aforementioned three insurers connected to make up a large portion of the exchange market in 2017, but they weren't quite as dominant as they were in the past: Kaiser had 28 pct of the market share, Blue Shield had 25 percent, and Anthem had 19 percent (a little over half of those Anthem enrollees had to select new coverage for 2018 due to Anthem'due south shrinking coverage surface area that year. Molina had 12 percentage of the Covered California market in 2017, and Health Net had eleven percent.) The other six insurers had a combined 6 percent of the market share.

UnitedHealthcare exited the individual market place in California at the cease of 2016, as was the example in most of u.s. where they offered plans in 2016. By Feb 2016, UnitedHealthcare had about 1,400 enrollees in Covered California (less than a third of a percent of the exchange's total QHP enrollment).

UnitedHealthcare and Oscar were both new to the commutation for 2016. United Healthcare applied in January 2015 to join Covered California country-wide, but the exchange initially rejected the proposal, citing a dominion that requires carriers to wait at least 3 years to enter the marketplace if they didn't offer plans for sale starting in 2014. In February 2015, the exchange issued a compromise, allowing United Healthcare the opportunity to sell plans in five of the state's 19 regions where fewer than 3 carriers offering coverage. United'south participation was brusque-lived, however, as they left after merely one year.

California enacted legislation (A.B.156) in late 2017 that codified a three-month open enrollment period, with enrollment beginning Oct 15 and continuing until January 15.

The state then enacted boosted legislation (A.B.1309) in 2019, which keeps the three-calendar month open up enrollment window but aligns the showtime of open enrollment with the November 1 appointment that'south used in the rest of the country, and pushes out the end appointment until Jan 31. This new schedule is permanent, then enrollment in Covered California, and outside the exchange, volition run from November ane through January 31 each twelvemonth.

Under the terms of California'south 2019 legislation, people who enroll by December 15 will have coverage effective January 1. (This has consistently been extended a bit each year.) People who enroll between December 16 and January 31 will have coverage effective February 1.

California was the first state to authorize a land-run commutation under the Affordable Care Act, with sometime Gov. Arnold Schwarzenegger signing legislation in 2010 to create the exchange. California'southward exchange — Covered California — is widely considered 1 of the land'due south most successful. As of March 2022, Jessica Altman, who previously served as Pennsylvania'due south insurance commissioner, will be Covered California'southward CEO, replacing Peter Lee, who had been the CEO of Covered California since its inception.

Enrollment in California's commutation is 2nd just to Florida — and maybe Texas — with more 1.8 million individual market enrollees as of early 2022. There were also more 62,000 people enrolled in small-scale group plans through Covered California'south Store platform every bit of belatedly 2020.

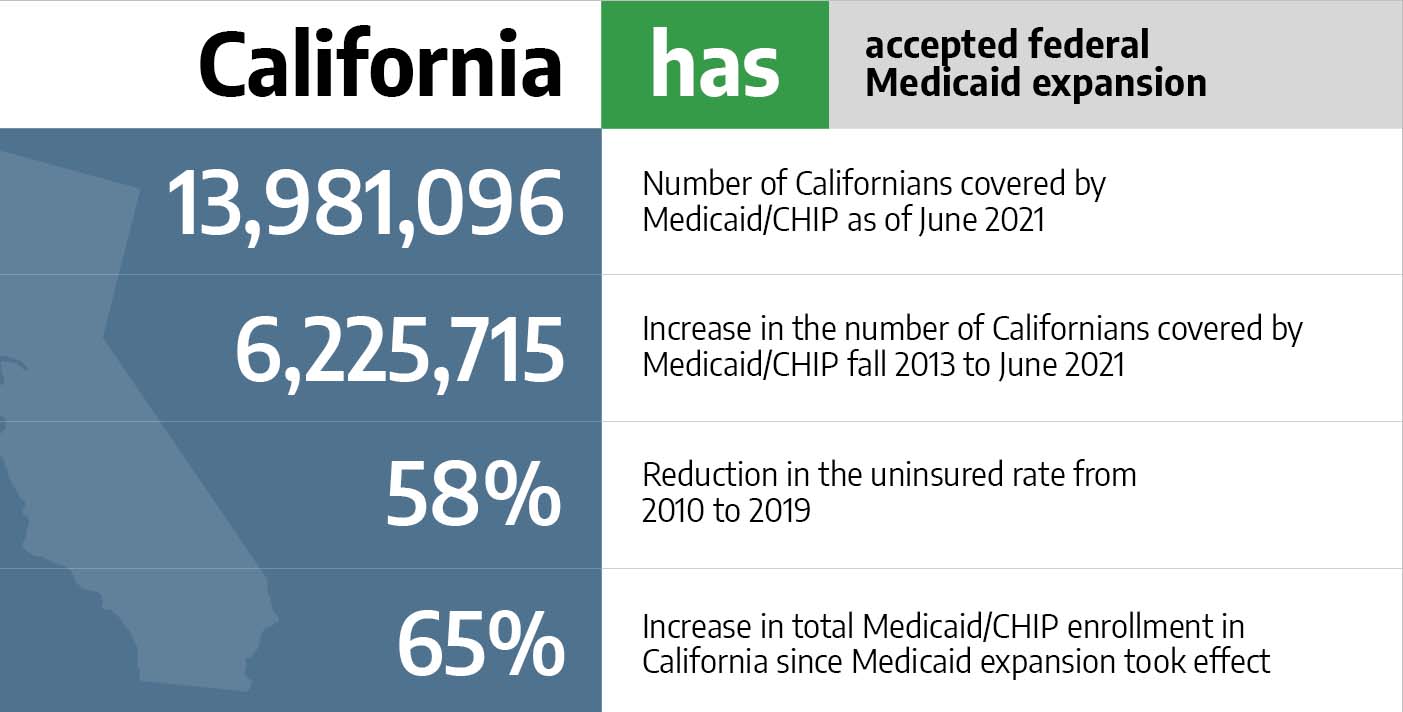

Covered California has as well enrolled millions of people in Medi-Cal (Medicaid) since the exchange began operating in 2013 (Medicaid enrollment fluctuates throughout the year, but California'due south total enrollment in Medicaid and CHIP grew by more than than 5 1000000 people from late 2013 to July 2021). Not coincidentally, the state'southward uninsured rate has dropped considerably: From 17.2% in 2013 to 7.2% in 2018, co-ordinate to US Demography data (although it increased to 7.7% in 2019).

California has been proactive in terms of enacting legislation to ensure that the individual market remains stable: California constabulary banned the sale of short-term health insurance plans as of 2019, and prevents sole proprietors and partners from purchasing association health plans coverage instead of individual market place plans. And every bit of 2020, California implemented an individual mandate and began offering country-based premium subsidies for people earning up to 600% of the poverty level (these subsidies are no longer necessary in 2021 and 2022, considering the American Rescue Plan has enhanced federal premium subsidies, more than than covering the portion that California had previously been covering).

Covered California is ane of ten land-run exchanges that uses an "active purchaser" model, meaning that they negotiate direct with carriers to make sure that rates, networks, and benefits are as consumer-friendly as possible (the remaining state-run exchanges and the federally-run exchange simply gear up minimum standards that carriers must come across, and then allow the sale of whatever plans that encounter those guidelines; that's known as a clearinghouse model as opposed to an active purchaser model).

Covered California is also the simply substitution in the country that requires all health plans to exist standardized, which means that within a single metallic level, all plans have the same benefits (with the exception of HSA-qualified plans, which are also standardized only with benefits that are different from the other bronze and silvery plans; Covered California's board approves changes to the standardized HSA-qualified do good pattern, equally needed to comply with IRS regulations pertaining to HSA-qualified plans).

Covered California announced in July 2021 that the preliminary private market charge per unit changes for 2022 amount to a 1.eight% increase. Every bit of Oct 2021, residents tin window-shop on Covered CA to see rates and plans for 2022.

The rate changes for 2022 are college than the charge per unit changes have been for the by two years (when they were under 1% each year), but the average rate increase across the three-year window amounts to just 1.ane%, indicating pregnant stability in the country'due south private insurance market.

Anthem Blue Cross of California, Blue Shield of California, and Valley Health Plan are all expanding their coverage areas for 2022, and Bright Health is newly joining the exchange.

The following rate changes utilise in California's individual marketplace:

- Anthem Blueish Cross of California (expanding to cover Alameda, Contra Costa, El Dorado, Marin, Napa, Placer, Sacramento, San Francisco, San Mateo, Solano, Sonoma, and Yolo counties): 2.5% decrease.

- Blueish Shield of California (expanding to cover parts of Monterey and Santa Barbara counties): i.three% increment.

- Vivid HealthCare: New for 2022, offer plans in Contra Costa County.

- Chinese Customs Health Plan: one.7% increase.

- Health Net: 4.five% increase.

- Kaiser Permanente: two.2% increase.

- L.A. Care Health Plan: 2.nine% decrease.

- Molina Healthcare: 0.i% decrease.

- Oscar Health Programme of California: 8.6% increase.

- Sharp Wellness Plan: 0.7% decrease.

- Valley Health Programme: (expanding to comprehend San Benito and Monterey counties): five.v% increment.

- Western Health Reward: three% increase.

But as is always the case, weighted average charge per unit increases don't paint a full picture:

- They only apply to full-price plans, and very few enrollees pay total cost for their coverage (equally of February 2021, 85% of Covered CA enrollees were receiving premium subsidies; that percentage increased afterwards in 2021, after the American Rescue Plan was implemented). For people who are receiving subsidies, the net rate change from one year to the side by side will depend on how their specific plan'due south rates are changing, as well equally any changes in their premium subsidy amount (which depends on the cost of the criterion plan, as well as the enrollee's projected income for the coming year).

- Overall boilerplate rate changes as well don't account for the fact that premiums increase with historic period, so people who maintain private market coverage for several years volition keep to pay more each year — just due to the fact that they're getting older — fifty-fifty if their wellness program technically has an overall rate change of 0% during that time.

- A weighted average, by definition, lumps all the plans together. Just different insurers offer plans in each region, and each insurer's charge per unit change is different. And so the specific charge per unit change that applies to a given enrollee can vary quite a scrap from the average.

For perspective, here's a look at how overall average premiums accept inverse in California's marketplace over the concluding several years:

2015: Increase of 4.2 percent.

2016: Increase of four percent. The commutation noted that consumers who shopped around during open enrollment would take the opportunity to lower their premiums by an average of 4.5 percent, and equally much as x per centum in some areas of the state.

2017: Increment of xiii.two percentage. This was more than than triple the average rate increases in 2015 and 2016, just it was besides considerably lower than the average rate increases that were implemented in many other states for 2017.

2018: Increase of 12.5 per centum plus an additional 12.4 pct for silver plans. California's Insurance Commissioner appear on Apr 28 that insurers in California could file two sets of rates for 2018 plans: "ACA rates" and "Trump rates," with the latter based on the higher premiums that would be necessary if the Trump assistants continued to sabotage the ACA. Every bit of Baronial 2017, the weighted average rate increment beyond all 11 CoveredCA insurers was 12.v percent. Only that was based on the assumption that toll-sharing reduction (CSR) funding would keep to be provided past the federal government. Ultimately, Covered California decided to implement the CSR surcharge (ie, a larger rate increment for silver plans) on October eleven, the mean solar day before the Trump administration announced that CSR funding would indeed end immediately. The boilerplate surcharge on silverish plans was an additional 12.4 percent, on top of the charge per unit increment that would have applied otherwise (details below about Covered California's approach to CSR funding).

2019: Increase of eight.7 percentage. The weighted average rate increase for 2019 was 8.seven percent, just the exchange noted that it would only have been most 5 pct without the elimination of the individual mandate penalization at the end of 2018 (California implemented its own individual mandate and penalty as of 2020).

2020: Increase of 0.nine percent: Insurers in California'southward individual market finalized a weighted boilerplate rate increment of 0.9 percent, which was the lowest the state has seen since ACA-compliant plans became bachelor in 2014 (the average increase for 2021 ended upwardly being even lower, as noted above).

2021: Increment of 0.6%: Covered California's individual market insurers proposed an overall average rate increase of 0.6 percent for 2021, and the rates were approved essentially every bit-filed. This amounted to a record-depression charge per unit increase for Covered California plans. And two of the insurers — Oscar and Anthem Blue Cross — expanded their coverage areas for 2021. Eleven insurers offer plans through Covered California in 2021. Six of the insurers implemented boilerplate charge per unit decreases that ranged from 0.five% to 4.vi%, and five insurers implemented average rate increases that ranged from 1% to nine%.

2014: 1,405,102 people enrolled in private plans through Covered California during open enrollment for 2014 coverage.

2015: one,412,200 people enrolled in private plans through Covered California during open enrollment for 2015 coverage.

2016: i,575,340 people enrolled in private plans through Covered California during open enrollment for 2016 coverage.

2017: one,556,676 people enrolled in private plans through Covered California during open enrollment for 2017 coverage.

2018: 1,521,524 people enrolled in private plans through Covered California during open enrollment for 2018 coverage. Full enrollment, including renewals, was slightly lower than it had been in 2017, simply the lower enrollment volume may have been due to the country's approach to handling the Trump Assistants's decision to end federal funding for cost-sharing reductions (CSR). California led the way in encouraging non-subsidy-eligible enrollees who preferred silver-level plans to shop outside the exchange in gild to avoid having the cost of CSR incorporated into their premiums.

2019: 1,513,883 people enrolled in private plans through Covered California during open up enrollment for 2019 coverage. Covered California noted that although enrollment was very similar to the prior year, there was a considerable drop in new enrollments. This coincided with the elimination of the federal individual mandate penalty at the end of 2018, and the exchange reiterated the demand to establish an individual mandate in California. Lawmakers did just that in the 2019 session, and the state's new mandate will take effect in Jan 2020.

2020: 1,538,819 people enrolled in private plans through Covered California during open enrollment for 2020 coverage. This was about 1.6 percent higher than the prior year'southward enrollment, after three straight years of year-over-year enrollment declines. California'southward new private mandate and state-funded premium subsidies are a big role of the reason enrollment increased (combined with a very modest rate increment, which is partly due to land's new individual mandate).

2021: 1.57 million people had enrolled in plans with a Jan 1 constructive date, just open enrollment continued through the end of January, probable calculation to that tally. The exchange noted that this was a record high for that point in the open enrollment window.

Would ACA subsidies lower your health insurance premiums?

Utilise our 2022 subsidy calculator to run into if yous're eligible for ACA premium subsidies – and your potential savings if you qualify.

Obamacare subsidy computer *

Estimated annual subsidy

Provide data in a higher place to get an estimate.

* This tool provides ACA premium subsidy estimates based on your household income. healthinsurance.org does not collect or store any personal information from individuals using our subsidy calculator.

"Easy enrollment" legislation under consideration in 2022

Subsequently Maryland created an "piece of cake enrollment" plan that debuted in 2020, several other states have followed suit or are in the process of doing so. The idea is to let residents indicate on their state revenue enhancement returns whether they are interested in learning more than nigh low-toll or no-cost health coverage options that might be available to them. The taxation filer can simply check a box on their state tax return, and their applicable information are then shared with the land'due south health insurance exchange. The commutation can so make a preliminary determination almost whether the person (and their spouse and dependents, if applicable) may be eligible for Medicaid, CHIP, or premium revenue enhancement credits in the marketplace.

In 2022, lawmakers in California are considering SB967, which would create an easy enrollment plan in California. Different most of the other states that have created or considered similar programs, the California legislation does not specifically create a special enrollment period for people who are deemed eligible for market place coverage (as opposed to Medicaid/CHIP, which is available year-circular). But if the legislation is enacted, Covered California would presumably create a special enrollment period for this purpose, as eligible enrollees would otherwise accept to wait until the annual open enrollment catamenia to obtain coverage.

New constabulary volition permit some California residents to add together parents to their health plan as dependents

California A.B.570, enacted in Oct 2021, makes California the get-go land in the country to provide a pathway for some policyholders to add their parents to their wellness plan as dependents.

The legislation only applies to individual/family wellness plans (ie, non to plans that people get from an employer), and it will take effect in 2023. Nether the new law, a California resident with individual/family unit health coverage will be able to comprehend parents equally dependents, as long as the parents rely on the policyholder for at least 50% of their living expenses.

An earlier version of the nib would have applied to employer-sponsored wellness plans too, just was opposed by business groups that worried about the cost. With the modification to make the legislation utilize only to individual/family unit plans, the state expects that only near 15,000 people will employ the option to add together parents to their health plan.

California allocated $295 1000000 to provide additional premium subsidies (no longer necessary with the American Rescue Plan in place)

California enacted legislation in 2019 to create a temporary state-based premium subsidy for Covered California enrollees with household income up to 600% of the poverty level (for a family of iv enrolling in a plan for 2020, that amounted to a household income of up to $154,500).

California's upkeep neb (A.B.74) included an appropriation of $295 meg to cover the cost of the subsidy program, with 75% of that money allocated for enrollees who don't go any federal subsidies (ie, those with income between 400 and 600% of the poverty level) and 25% allocated for enrollees who earn betwixt 200 and 400% of the poverty level (ie, they are already eligible for federal premium subsidies, just California would provide supplemental subsidies; according to a Covered California printing release, small-scale subsidies were also available to some households with income beneath 138% of the poverty level; these are individuals who aren't eligible for Medicaid due to immigration status, which means they haven't been in the United states of america for at least five years). The state-based premium subsidies were also addressed in S.B.78, which clarifies that the subsidies aren't available afterward 2022.

Covered California reported that 486,000 had already enrolled in plans with fiscal assistance under the new country-based premium subsidies every bit of December 12, 2019. The substitution estimated that a total of 922,000 people would exist eligible for the state-based premium subsidies. In February 2020, Covered California reported that near 47% of applicants with income betwixt 400 and 600% of the poverty level had qualified for the state-funded subsidy, and the average subsidy corporeality for those households, roofing 32,000 consumers, was $504 per household per month.

The exchange had previously estimated that up to 663,000 people with income between 200 and 400 per centum of the poverty level would qualify for an average of $12/month in premium subsidies from the country of California, in addition to the subsidies they become from the federal government. Another 23,000 low-income California residents (whose income would really brand them eligible for Medi-Cal (Medicaid), but they aren't eligible considering they haven't been in the The states for at least v years) were projected to be eligible for an average of $i/calendar month in additional subsidies from the state of California, on top of the substantial federal premium subsidies available to these enrollees.

Simply as of 2021, the state-based premium subsidies are no longer necessary. That's because the American Rescue Programme's enhanced federal subsidies bring net premiums well beneath the level they would accept been with the previous federal + state subsidies. And so although California residents are no longer receiving state-based subsidies in 2021, they are receiving additional federal subsidies that more than make up the divergence. The result is later-subsidy premiums that are lower than they were earlier the American Rescue Plan was enacted, even though the country-funded subsidies are no longer applicable. (Annotation that CoveredCA has said that they will automatically employ the new subsidies to enrollees' accounts equally of May 2021).

California created an private mandate that took consequence in 2020

California also enacted S.B.104 and South.B.78 in 2019, in order to create an private mandate in California starting in 2020. The penalisation for not-compliance will be based on the federal individual mandate penalty that applied in 2018 (ie, $695 per uninsured developed, or 2.five percent of household income), just exemptions and maximum penalties will exist California-specific. For instance, the state notes that because California's revenue enhancement-filing threshold is college than the IRS filing threshold, 115,000 fewer people volition have to pay California'due south individual mandate penalty, compared with the number of people who would have had to pay the federal penalization if it had remained in effect.

As a result of the state-based premium subsidies and private mandate, California estimated that 229,000 additional people would obtain coverage in 2020. And the restored private mandate penalty kept premiums 2 to five percent lower than they would otherwise accept been, resulting in an overall average rate increase of less than ane pct — the smallest the country has seen since ACA-compliant policies debuted in 2014.

Covered California's enrollment total for 2020 ended up at 1.54 one thousand thousand for 2020, as opposed to i.51 million in 2019. And afterwards open up enrollment concluded, Covered California opened a special enrollment menstruum through April 30 for people who didn't know near the land's new premium subsidies and/or the state'southward new individual mandate.

The special enrollment period immune people who were uninsured to enroll in a programme through Covered California, and it as well allowed people with off-exchange coverage to transition to on-exchange coverage, in gild to take advantage of the land-funded premium subsidies (and federal ACA subsidies, if applicable). This was important, as Covered California estimated that there are 280,000 people with off-substitution coverage — who had at least initially kept that coverage for 2020 — who would exist eligible for premium subsidies (from the country and/or federal government) if they switched to an on-exchange plan.

The exchange's fact canvass near the special enrollment period notes that they were "working with issuers and regulators on a plan to permit the

transfer of deductibles accumulated off-exchange to an on-Exchange health programme." This is a crucial aspect of assuasive a seamless transition to an on-exchange plan, for people who were previously insured off-exchange. (Normally, transitioning from off-substitution to on-exchange (or vice versa) during a special enrollment period ways that the person has to showtime over with a new deductible and out-of-pocket maximum, regardless of whether they've already incurred charges under their old plan during the starting time part of the year.)

People who enrolled in a Covered California programme during the special enrollment period had coverage effective the first of the month afterwards they applied. California's new individual mandate has an exemption available for people who only accept one brusque gap in coverage that's not more than iii months long. So a person who was uninsured could enroll past March 31, have coverage effective April one, and will not owe a penalty for existence uninsured in 2020 as long as they maintain their coverage for the residual of the year. But an uninsured person who enrolled in Apr would take had coverage constructive May 1, which ways they'd have a four-calendar month gap in coverage (Jan through April). That volition trigger a penalty (assessed on their 2020 revenue enhancement return, filed in early 2021) equal to one-third of the annual penalty amount, assuming they maintain coverage for the final eight months of the year and aren't otherwise exempt from the penalty.

2018 legislation: Short-term plans banned; AHPs non allowed for self-employed individuals

California enacted several pieces of legislation in 2018 addressing wellness care reform in California. They include:

- South.B.910: Prohibits the sale of brusk-term wellness insurance plans as of Jan 1, 2019. The Trump Assistants has rolled back the Obama Administration regulations that shortened the allowable duration of brusk-term plans. S.B.910 is an effort to protect the state's major medical individual marketplace, and preclude short-term plans from siphoning off the healthiest members into lower-cost plans.

- S.B.1375: Prohibits sole proprietors and partners in a partnership (along with their spouses) from beingness considered "eligible employees" who tin purchase small group wellness insurance. This ways such individuals cannot purchase association wellness plan coverage, and must instead purchase coverage in the individual marketplace if they wish to obtain health insurance. As with S.B.910, the bespeak of this legislation is to protect the overall health of the risk pool for private market place coverage in California, so that the healthiest members cannot shift to clan health program coverage instead (as of mid-2019, association health plans can no longer market to sole proprietors in any states nether the Trump administration rules that were rolled out in 2018, as a federal judge has invalidated the rule and an appeal is pending).

- A.B.2499: Codifies medical loss ratio (MLR) requirements into California law. Existing regulations in the state simply required insurers to comply with the federal medical loss ratio rules. But A.B.2499 clarifies the specifics in California police, which volition remain in place even if the federal MLR requirements are repealed in the future. Big group plans must spend at least 85 per centum of premiums on medical claims and quality improvements, while individual and small grouping plans must spend at least 80 percent. An earlier version of the bill called for codifying more stringent MLR rules in California (xc per centum for big group plans and 85 percent for individual and small grouping plans), but the version that was enacted simply mirrors the existing federal rules.

- A.B.2472: This legislation requires the California Council on Health Care Delivery Systems to analyze "the feasibility of a public health insurance programme option to increment competition and choice for health care consumers" and submit a feasibility report to the legislature by October 2021. An earlier version of the neb would have allowed people who aren't eligible for Medicaid to buy into the Medicaid programme., essentially creating a public health insurance pick in California that would operate alongside the private plans that are available for purchase (the state would have had to obtain a waiver from the federal government in gild to implement a Medicaid buy-in program). The feasibility assay could still end up recommending a Medicaid purchase-in program but the current law only calls for an analysis and report, rather than moving forrard with Medicaid buy-in.

California has its own de minimis range for metal level actuarial value

Nether the ACA, all new plans have to conform to one of four metal levels (in addition to catastrophic plans). The metal level delineation is based on actuarial value (AV): Bronze plans comprehend 60 percent of average costs across a standard population, argent plans cover lxx percent, golden plans cover 80 percent, and platinum plans cover 90 percent. But considering information technology'south difficult to hitting that number exactly, an allowable de minimis range of +/-2% was incorporated in the requirements.

The market stabilization regulations that HHS finalized in April 2017 allow the de minimis range to expand to +2/-4%. And then a plan with an actuarial value of 66 to 72 per centum would be considered a silver plan, and the new rules took result for the 2018 plan year.

But California has its own state law that allowed de minimis variation of only +/-ii%, so the less stringent federal regulation did not take event in California at that point; plans still had to comply with the existing rules (ie, silver plans must have an actuarial value of 68 to 72 percent, for case).

In 2019, California enacted legislation (SB78) which, amongst many other provisions, provides more than flexibility on the de minimus range for actuarial value. But instead of the approach that HHS took, of allowing insurers to err more on the low cease of the actuarial value range, California is doing the reverse: The new legislation allows plans to have a de minimus range of +4/-ii%, which means that plans can have AV upwards to 4 points above the target number, but tin still only get ii points beneath it. Under California's new rules, a silvery plan could have an AV of 68 to 74 percent.

California withdrew proposal to allow undocumented immigrants to purchase coverage through Covered California

SB10 was signed into law in California in June 2016. The law allows undocumented immigrants to purchase unsubsidized coverage in the exchange, but a waiver from HHS was necessary in order to movement frontwards, since the ACA forbids undocumented immigrants from purchasing coverage in the exchanges.

California's waiver proposal was complete as of January 17, 2017, which was the outset of a 30-day public comment catamenia. Just on Jan 18, the state withdrew the waiver at the request of California State Senator Ricardo Lara (D, Bong Gardens), the senator who had introduced and championed SB10 (Lara is the senator who introduced S.B.562 in an effort to bring single-payer to California). Governor Jerry Brownish agreed with Lara's determination to withdraw the waiver proposal.

The state withdrew the proposal because they were concerned that the Trump administration might use information from the exchange to deport undocumented immigrants. Lara said that he didn't "trust the Trump administration to exercise what'southward all-time for California and to implement the waiver in a way that protects people's privacy and health." He called the withdrawal of the waiver "the offset California casualty of the Trump presidency."

Undocumented immigrants can already buy full-toll coverage outside the exchange. It's not clear how much SB10 would accept decreased the uninsured rate among undocumented immigrants if it had been implemented, since they would nevertheless have been required to pay full price for their coverage in the exchange.

Covered California caps monthly prescription costs

The cost of high-end prescription drugs is a growing problem for healthcare cost sustainability, and the rising cost of prescriptions is cited repeatedly in justifications provided past insurers requesting double-digit rate increases. Only the cost of specialty medications can also be an insurmountable brunt for patients, fifty-fifty when they have health insurance. For high-terminate specialty medications, like Sovaldi, information technology's not uncommon for patients to reach their maximum out-of-pocket exposure very chop-chop, paying thousands of dollars per month in coinsurance for their medications.

In May 2015, Covered California rolled out a cap on prescription costs that went into effect in 2016, along with various other benefit enhancements that allow consumers admission to more care without having to run into steep deductibles. Because Covered California requires program standardization on and off-exchange, the prescription copay cap is as well available to many consumers purchasing plans outside the commutation. The cap is linked to the metal level of the programme purchased; for the majority of consumers, the cap is $250 per specialty medication per month, but it ranges from $150 to $500, with statuary plan enrollees having the highest specialty drug copay cap.

The California legislature also created a similar cap land-broad, to include non-grandfathered group and private plans sold only exterior Covered California. Assembly Nib 339 was signed into law in October 2015, and took outcome Jan i, 2017. It applies to all non-grandfathered private and modest group plans in the state, and limits the copayment for a xxx-day supply of any medication to no more $250, until January one, 2020. For plans designated as high deductible policies, the copay limit would apply after the deductible is met.

Covered California stock-still pregnancy glitch

For part of 2015 and 2016, a glitch in Covered California'south arrangement had been automatically transferring privately-insured meaning women to Medi-Cal if their income made them eligible for Medi-Cal while pregnant. Medi-Cal is available to all adults with income upwards to 138 percent of the poverty level, but for pregnant women, the income threshold extends up to 213 percent of the poverty level.

Then a woman with income between 138 percentage and 213 percent of the poverty level would be eligible for a subsidized qualified health program (QHP) in the commutation if she's non pregnant, but for Medi-Cal if she is pregnant. And a pregnant woman counts as two people for Medi-Cal eligibility decision, just just 1 person for QHP subsidy eligibility decision, further increasing the number of women whose eligibility status could change with a pregnancy.

Some women had been reporting their pregnancies to Covered California, and the exchange had been automatically switching them to Medi-Cal without confirming that the woman wanted to switch. This caused virtually two,000 women to lose access to their healthcare providers considering of network changes, and the exchange began working as apace every bit possible to remedy the problem. Past September 2016, the outcome had been resolved, and meaning women are now given a choice of remaining on their QHP or switching to Medi-Cal

Some women prefer to switch to Medi-Cal, since they salve a considerable amount of money on premiums and out-of-pocket costs with Medi-Cal. But switching can mean having to cull a new doctor, which some women are uncomfortable doing mid-pregnancy.

California's Store exchange

California's Small Business concern Health Options Program (SHOP) exchange lets small employers sign up and offering coverage to their employees yr circular. Five insurers are offering medical plans through the Shop: Blue Shield of California, Chinese Community Health Program, Wellness Internet, Kaiser Permanente, and Precipitous Wellness Plan.

The Shop exchange in California has seen consistent growth, with 47,000 covered individuals every bit of 2018.

Pocket-sized businesses must submit a completed application and the first month's premium at least five business days before the terminate of the month to take coverage starting the first day of the following month. Employers determine the amount they're willing to pay for wellness insurance, and employees tin then select from among all the program options available in the Shop exchange; the employer gets 1 pecker each month, but employees accept a wide range of plan choices.

In 2015, Covered CA's Store exchange was open to businesses with one to fifty employees. That inverse in 2016 however, and businesses with up to 100 employees are now able to buy coverage. That was supposed to exist the instance nationwide, simply in October 2015, President Obama signed HR1624 into police force, keeping the definition of "pocket-sized group" at businesses with up to 50 employees (the ACA had called for expanding "small group" to include businesses with up to 100 employees starting in 2016).

States were withal allowed to expand their definitions of small businesses, and California had already aligned their laws with the ACA. California is ane of only four states to expand the definition of small group in 2016. California businesses with upwards to 100 employees autumn under the category of modest groups starting in 2016.

California health insurance exchange links

Other types of health coverage in California

Medicaid in California

Medi-Cal is the largest Medicaid program in nation, covering nigh 14 one thousand thousand Californians.

Medicare in California

California'due south 'birthday rule' provides an annual opportunity for Medigap enrollees to alter coverage.

christiannoing1976.blogspot.com

Source: https://www.healthinsurance.org/health-insurance-marketplaces/california/

0 Response to "California Health Insureance Need to Sign Up Again Each Year?"

Post a Comment